Tax Payments |

|

|

|

|

Tax Payments |

|

|

|

|

|

||

Overview of Tax Payments

Federal, state, and local agencies charge various taxes. The purpose of these taxes can range from payroll taxes to cover Social Security and Medicare to state sales taxes, licensing taxes, and any number of other kinds. At all levels, government agencies are moving to collecting taxes electronically. To standardize the payment of these taxes, the TXP format was created. This is actually an addenda format used in conjunction with the CCD+ format. Each governmental agency specifies its own TXP format, but the general form is:

705TXP*<taxpayer ID number>*<tax code>*<tax period end date>*<type field>*<transaction amount>\

For example, a payment of $5000.00 on federal tax code 94201 ending 9/1/2007 for taxpayer ID 123456789 would be:

705TXP*123456789*94201*070901*94201*500000\

Tax Payment Scenarios

There are several different common scenarios involving tax payments.

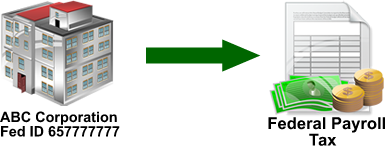

Scenario 1 - One Governmental Agency Profile, One Tax Format

One company makes one type of tax payment. For example, a corporation pays the Employer's Quarterly Tax Return.

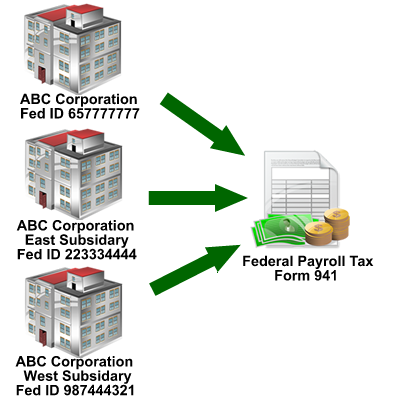

Scenario 2 - Multiple Governmental Agency Profiles, One Tax Format

A corporation and its subsidiaries or a corporation on behalf of its employees makes one type of tax payment. For example, the Federal Employer's Quarterly Tax Return which pays Social Security, Medicare, and Withholding taxes for each employee. There would be a profile for each governmental agency needing to pay the tax.

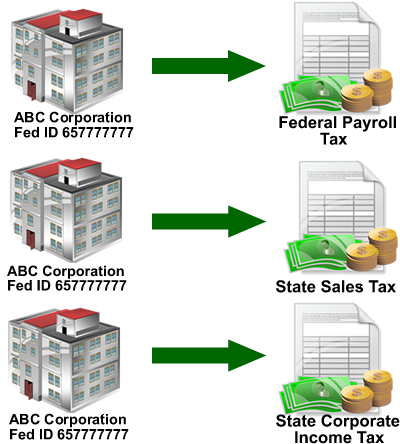

Scenario 3 - Multiple Governmental Agency Profiles, Multiple Taxes

A corporation pays several different taxes, such as the Employer's Quarterly Tax Return, state sales tax, and corporate income tax. A profile must be created for each tax the corporation needs to pay.

Scenario 4 - Combination

In reality, most tax payments can cover multiple scenarios. A corporation can have multiple subsidiaries, each making multiple types of tax payments. In addition, the corporation itself is required to make certain tax payments.

Regardless of the scenario, ACH Universal can be used to streamline your tax payments and avoid costly delays and penalties.

Making Tax Payments with ACH Universal

There are two parts to any tax payment.

•Tax format

•Profile linking an entity to a tax format

Tax Formats

A tax format is the formal specification from the taxing agency

Every tax format has:

•Name (Example: Employer's Quarterly Tax Return)

•Tax Form Number (Example: 941)

•Period Ending Date

•Banking Account Information

•Specific addenda structure

Electronic tax payments to the federal government are handled by EFTPS. Obtain tax codes and information at http://www.eftps.gov

Each state and local agency administers its own taxes. Contact each appropriate agency for their specification and more information.

ACH Universal contains an extensive tax library containing the most commonly used tax codes. However, it is possible to add any tax you need to pay to the library. See Creating a tax format for more.

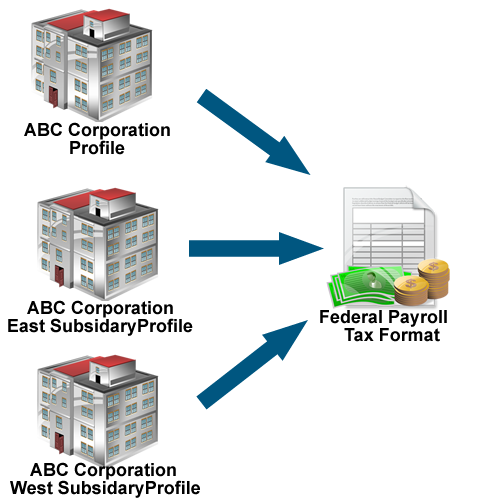

Profiles

A profile represents any entity having a tax paid on its behalf. A company will have 1 profile for every tax requiring a payment. In addition, a company's subsidiaries may make additional tax payments and each one will have a separate profile. Lastly, any tax payments on behalf of individuals, such as the Employer's Quarterly Tax Return, require a profile.

Above, ABC Corporation has a profile, as do both its East and West Subsidiaries.

Where to begin?

The first step is to create a tax format if it is not already in ACH Universal. See Creating a tax format.

If the format already exists, see Creating a tax profile to begin making profiles.