Creating a Tax Form |

|

|

|

|

Creating a Tax Form |

|

|

|

|

|

||

Creating a Tax Form

Following from the previous help page, we are now displayed with a tax form.

Think of the tax form as a template, or if you've ever performed a mail-merge - this is the letter.

You enter in the format that you want, as well as several constants.

Format tab

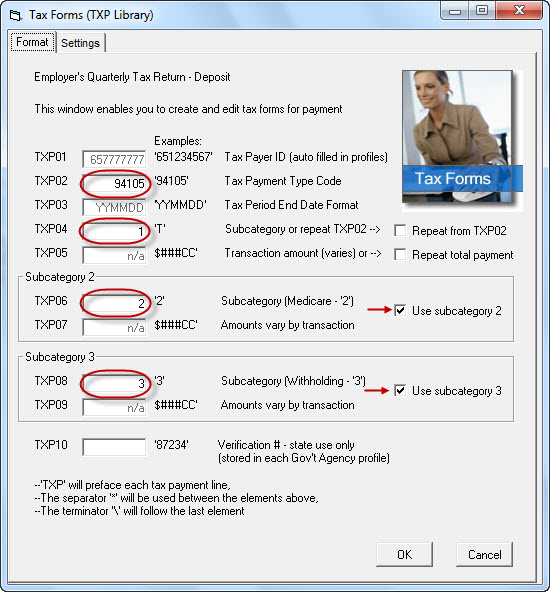

Below is a tax form for Federal payroll tax payments with Form 941.

While it looks like a lot, a number of the fields are pulled from the transactional and profile information.

By reviewing the instructions for the Federal Form 941, we realize that we need to make four entries, and enable two check boxes.

Whether a Federal or State agency, each piece of the addenda is labeled from TXP01 to TXP10. Fill out each field as required by the tax code:

TXP01 |

Taxpayer ID number. This field is filled automatically during ACH file creation based on the governmental agency profile. |

TXP02 |

Tax code number |

TXP03 |

Tax period end date format. For example, enter YYMMDD, not 090107 as the specific date is filled in automatically for each payment. |

TXP04 |

For most states, enter T. For most federal payments, enable the checkbox labeled "Repeat from TXP02." Consult your specification for exact requirement. |

TXP05 |

If the tax only contains a single payment, this field is the transaction amount. If the tax has subcategories, this is the amount for subcategory 1. |

TXP06 |

Tax code subcategory. Enter as specified by the tax code. If using, must enable "Use subcategory 2" checkbox. |

TXP07 |

Subcategory transaction amount. Cannot edit this field. |

TXP08 |

Tax code subcategory. Enter as specified by the tax code. If using, must enable "Use subcategory 3" checkbox. |

TXP09 |

Subcategory transaction amount. . |

TXP10 |

Verification number used only for state tax codes (never used for Federal tax payments). This field will be automatically filled during ACH file creation based on the governmental agency profile. |

Please note that Treasury Software does not maintain a database or service for any taxing authorities.

Settings tab

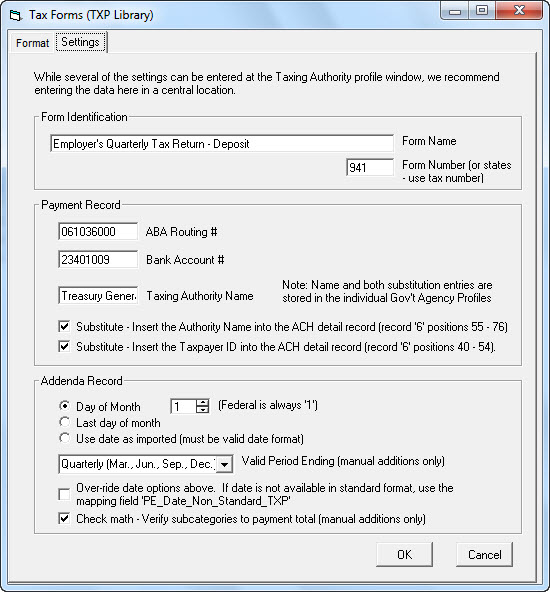

Now click on the Settings tab at the top of the form.

Note: The top section (Form Identification) does not carry over to the ACH file - it is for your internal use only.

When you are done, click 'OK' save your work and close the form.

Advanced

Question: Why do we need a Payment Profile (Gov't Agency) and a Tax Form? Why isn't the Tax Form just another tab on the Payment Profile?

Answer - Reuse.

You can use the same tax form for multiple profiles. If you are responsible to make tax payments under multiple tax payer ID's, you only need to create one tax form, but can use it with an unlimited number of Profiles.